Internal Fraud

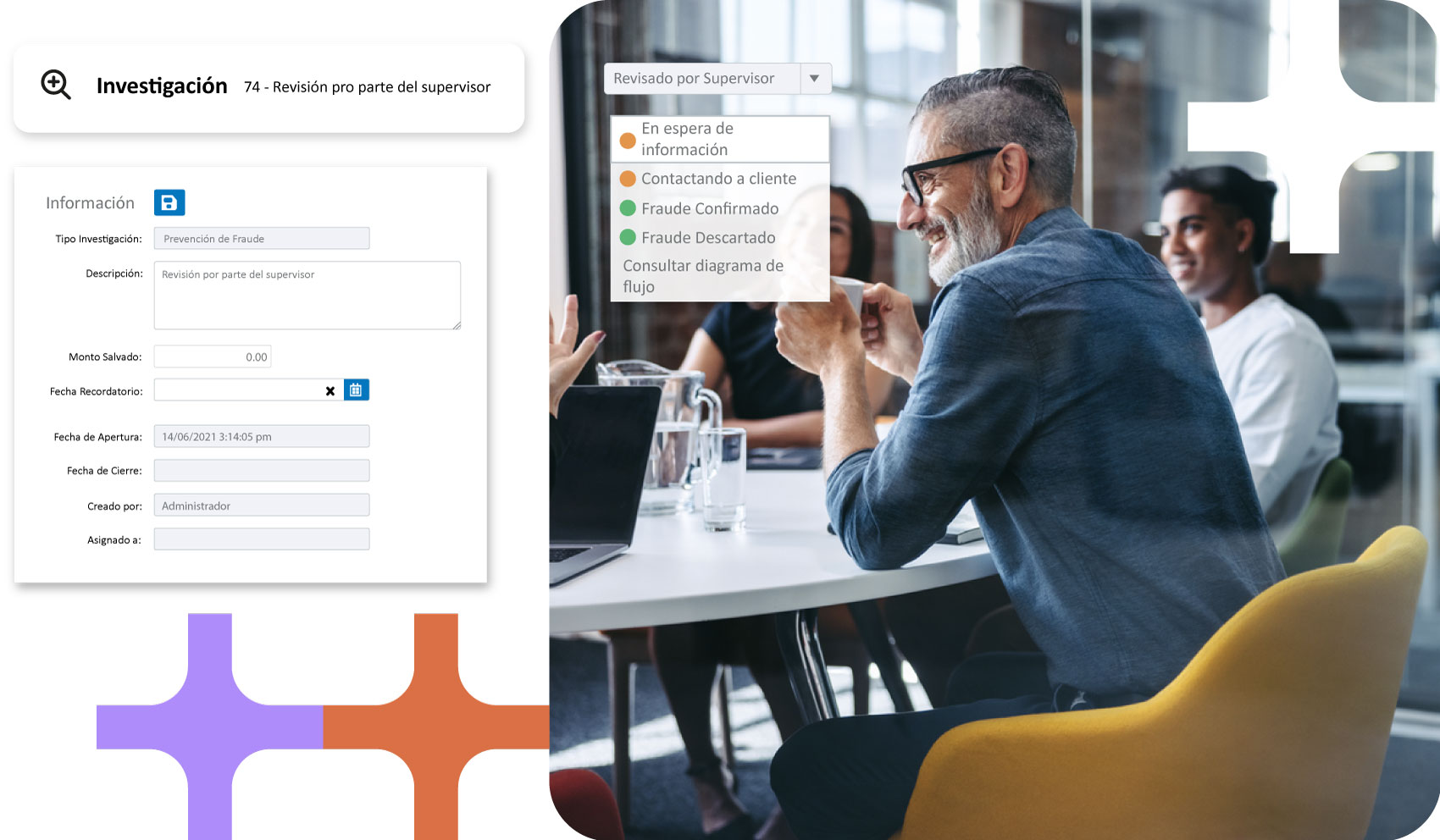

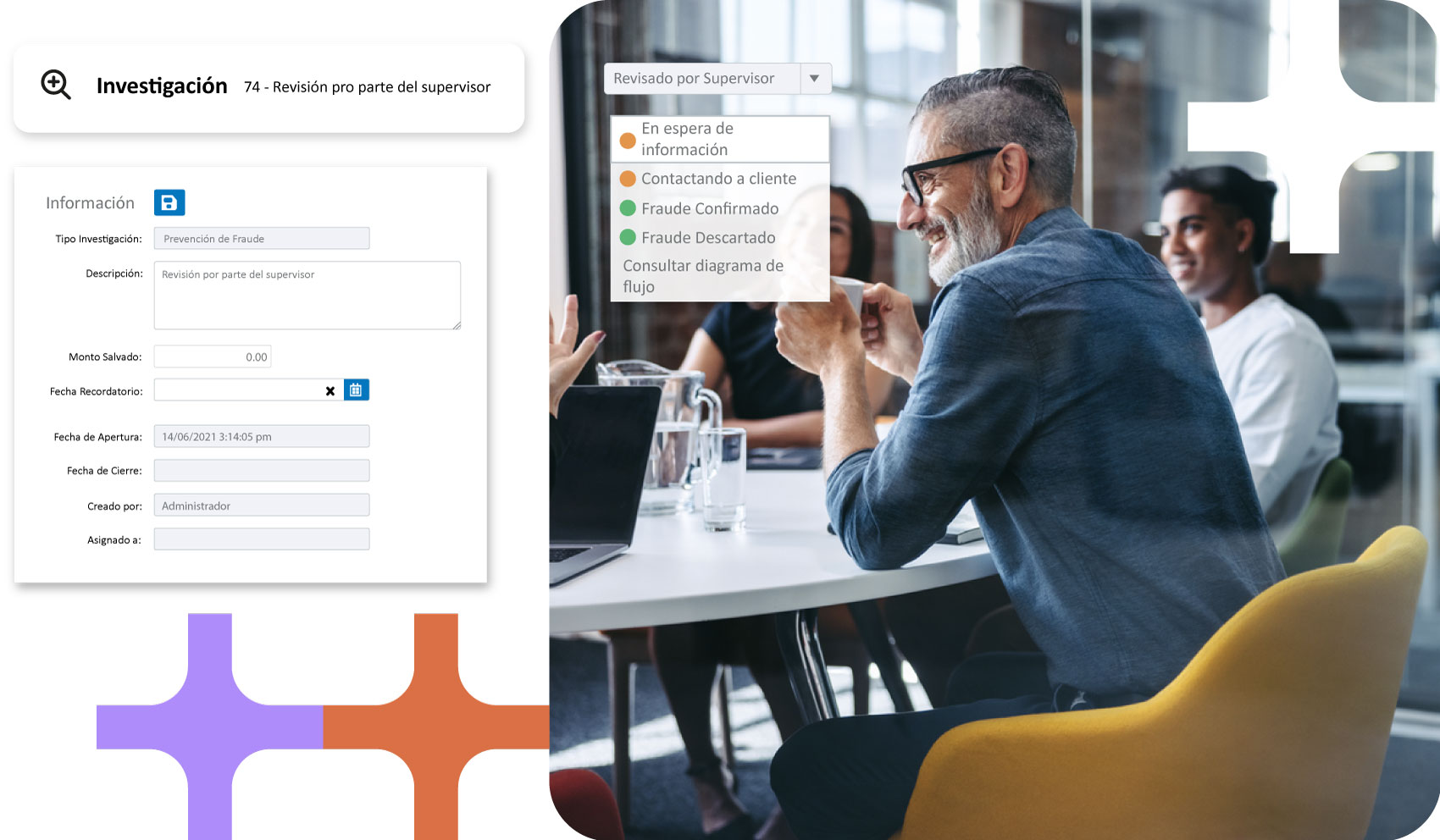

Un servicio que incluye diferentes etapas de análisis de riesgo y prevención del fraude interno, incluyendo múltiples tecnologías de detección, investigación, reportes y tableros de control.

Características

Las pérdidas por fraude interno representan un gran factor de riesgo para la operación de las entidades financieras y un impacto muy fuerte.

Además, uno de los principales problemas es el tiempo que se requiere para detectar el fraude y por tal motivo la efectividad de la recuperación.

Usos de la solución

Perfil de riesgo de los colaboradores, basado en múltiples factores.

Comportamiento histórico del colaborador en los sistemas corporativos.

Alertas tempranas ante comportamientos inusuales del colaborador en sus gestiones internas.

Integración con sistemas de Recursos Humanos y análisis de trazabilidad de estos.

Seguimiento de las cuentas de cliente asociados al funcionario.

Perfil de riesgo de los colaboradores, basado en múltiples factores.

Comportamiento histórico del colaborador en los sistemas corporativos.

Alertas tempranas ante comportamientos inusuales del colaborador en sus gestiones internas.

Integración con sistemas de Recursos Humanos y análisis de trazabilidad de estos.

Seguimiento de las cuentas de cliente asociados al funcionario.

Descansa con toda tranquilidad

Confía en que detrás de tu organización, Sentinel vigila cada transacción

Beneficios

Protege los activos de la empresa contra amenazas que puedan venir desde adentro de la misma.

Refuerza valores éticos de la empresa, vigilando el comportamiento interno de los colaboradores.

Asegura el cumplimiento de políticas internas establecidas.

Protege los accesos a la seguridad física de la empresa.

Protege las cuentas de los clientes.

Mejora la administración y la optimización de recursos dentro de la empresa.

Ayuda a desvincular con grupos de crimen organizado que amenacen las empresa.

Productos

Combate el crimen financiero de manera eficaz a través de sofisticadas herramientas.