Sentinel Acquirer Fraud

Immediately prevents, detects and eradicates fraudulent transactions at merchants, ATMs, and POS.

Characteristics

Makes it easy to analyze any deviation in invoicing and chargebacks.

Automatically and manually blocks payments to merchants.

Determines commitment points.

Creates transactional behavior profiles for merchants, ATMs, and POS.

Programs alert models according to the business seasons, to avoid unnecessary alerts.

Solution Uses

Rule-based models set up using a graphical editor and integrating different sources, statistical operators, functions, lists, condition groups and formulas.

Rule evaluator inserted in the main system environment with impact, efficiency and false positive analysis.

Forecasts expected business activity and identifies those that present positive or negative variations in invoicing and deposits.

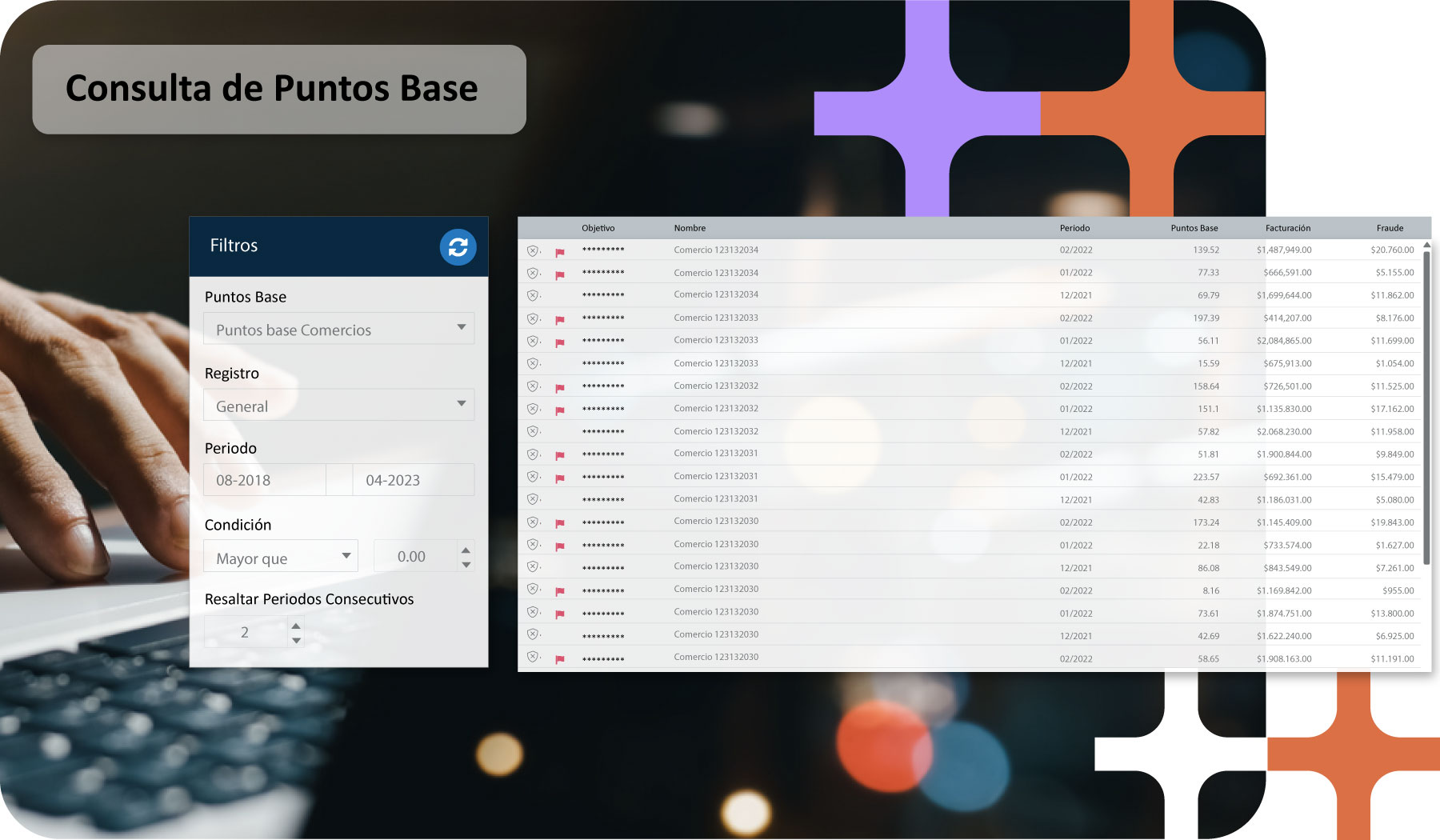

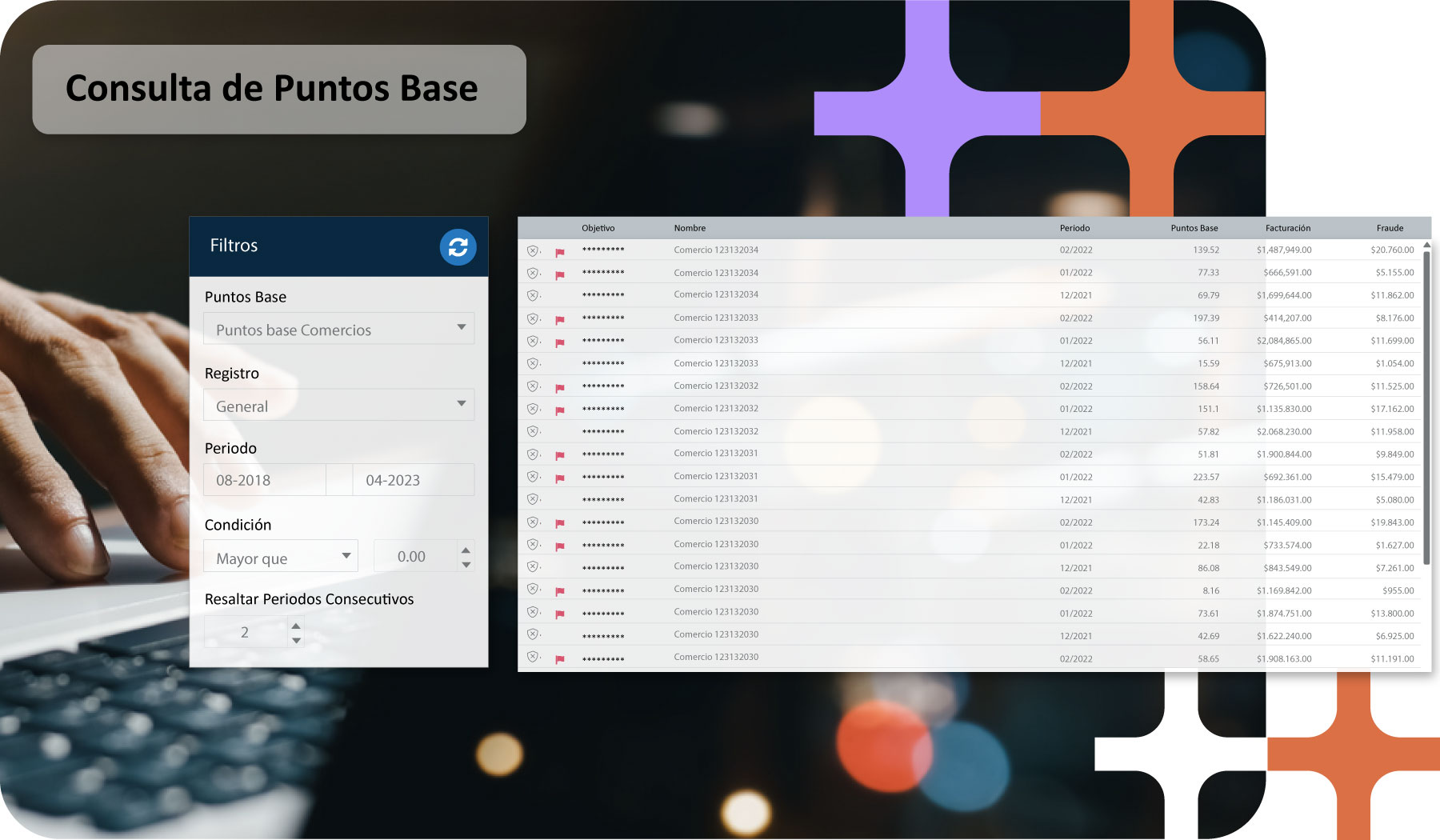

Identifies fraud base points of each merchant and defines alert thresholds.

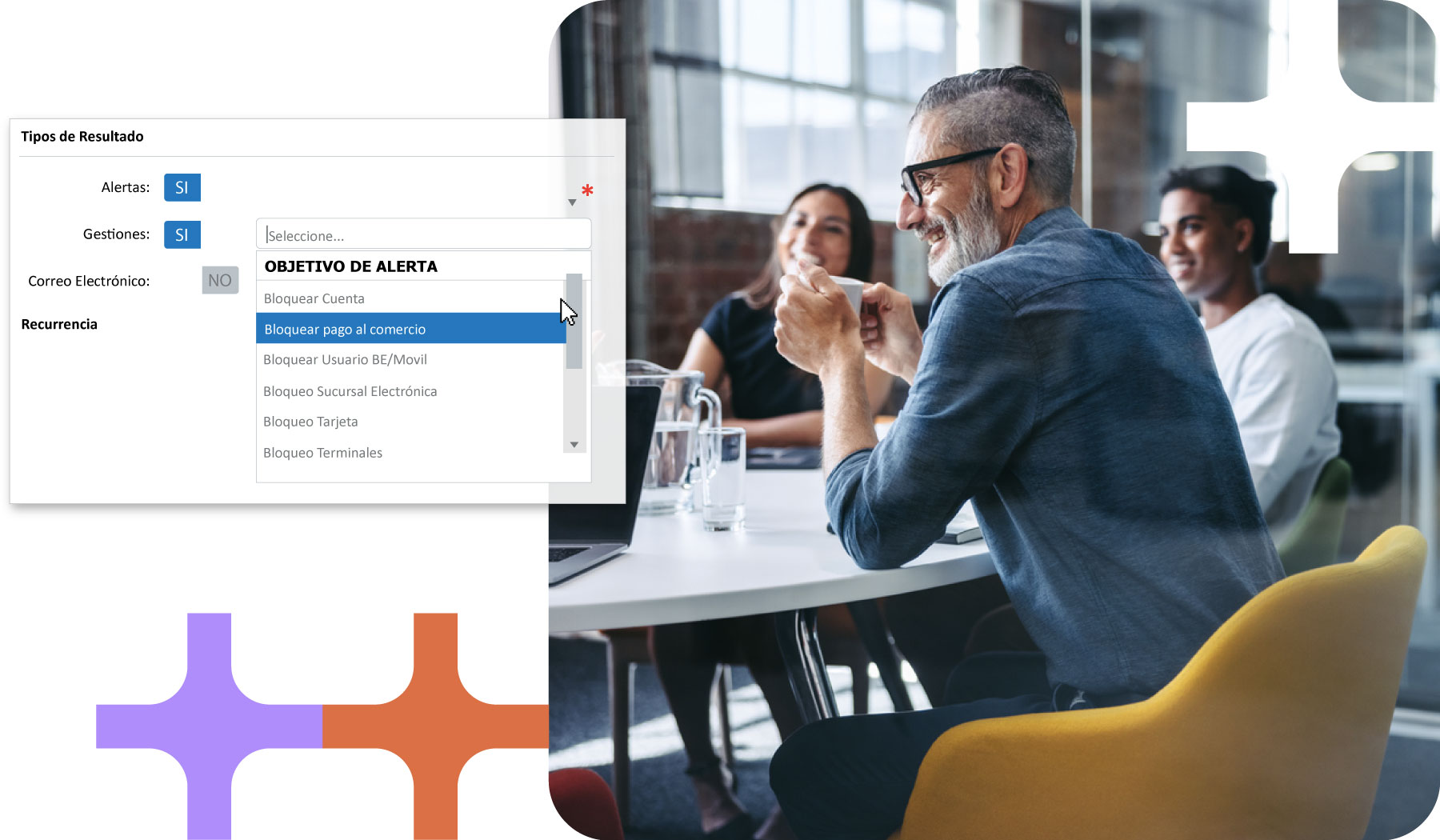

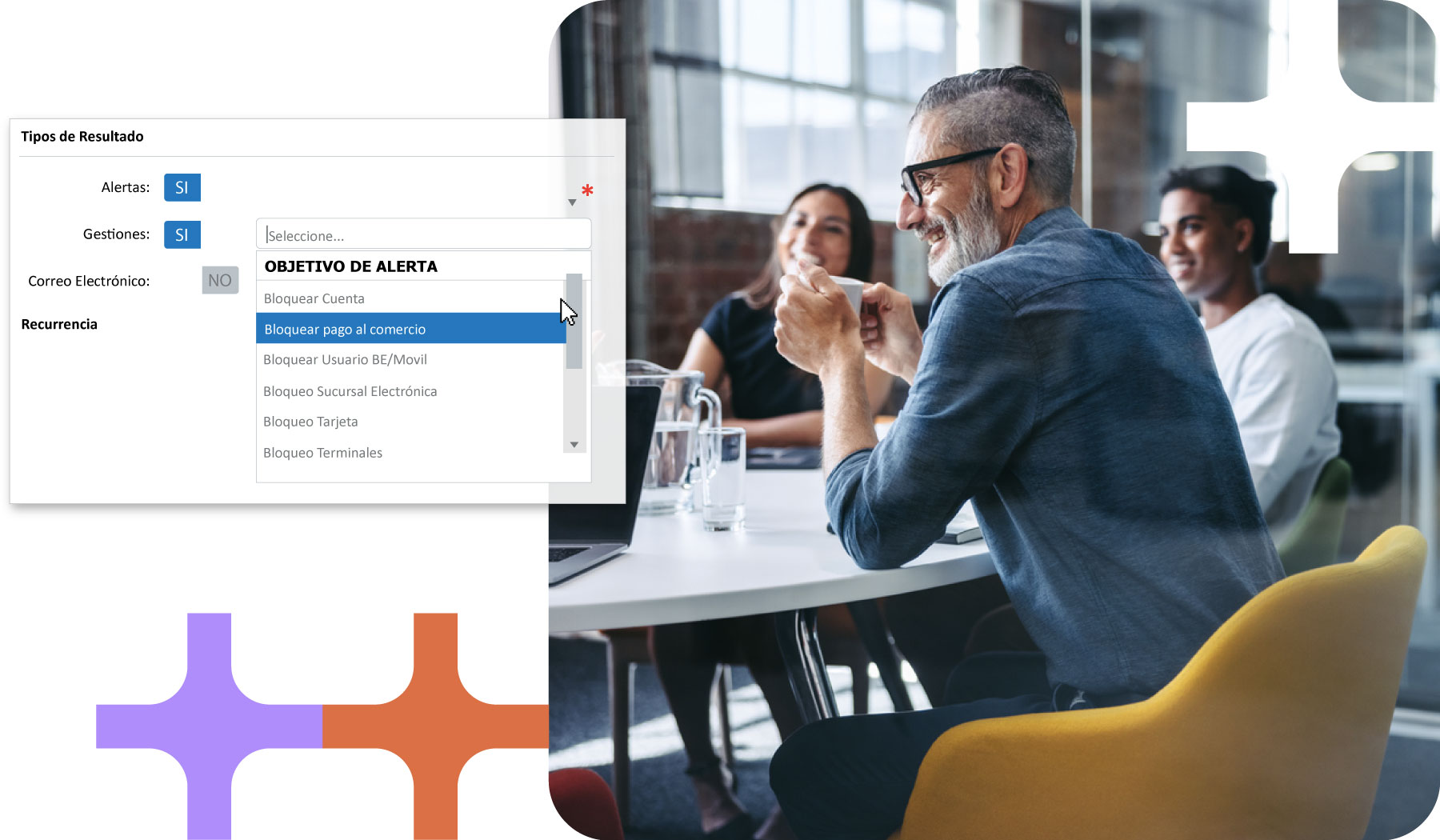

Generates manual or automatic blocks of payments to merchants.

Rule-based models set up using a graphical editor and integrating different sources, statistical operators, functions, lists, condition groups and formulas.

Rule evaluator inserted in the main system environment with impact, efficiency and false positive analysis.

Forecasts expected business activity and identifies those that present positive or negative variations in invoicing and deposits.

Identifies fraud base points of each merchant and defines alert thresholds.

Generates manual or automatic blocks of payments to merchants.

Rest easy

Trust that Sentinel keeps an eye on every transaction in your organization

Benefits

Monitors different channels: POS, Mobile POS, ATM.

Creates best practices and security alerts.

Makes cardholder transactions more convenient, reliable and secure.

Helps protect against losses caused by an increase in confirmed fraud.

Improves efficiency and performance of your research team by defining workflow and actions to be taken during the analysis and review of any unusual activity.

Boosts business by increasing approval rates and decreasing chargebacks.

Implements a fraud prevention strategy through the analysis of different technological components from multiple perspectives.

Products

Fight financial crime effectively with sophisticated tools.