E-commerce

Previene, detecta y erradica de forma inmediata transacciones fraudulentas en comercio electrónico.

Características

Facilita el análisis de la desviación en la facturación y los contracargos.

Crea perfiles de comportamiento transaccional para comercios electrónicos.

Determina puntos de compromiso.

Permite calendarizar modelos de alertamiento según las temporadas del negocio, para evitar alertas innecesarias.

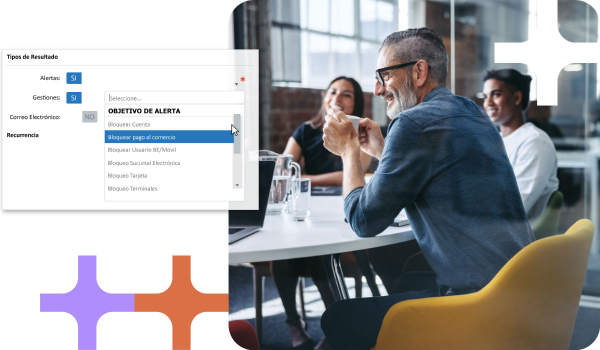

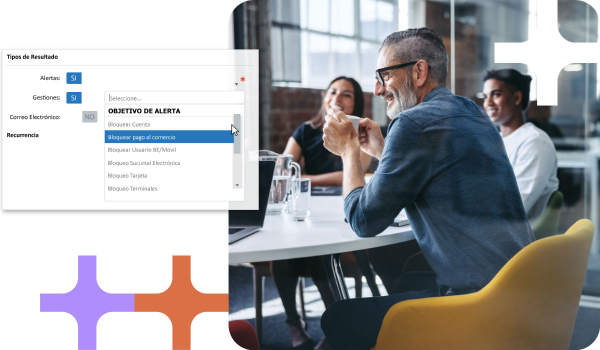

Bloquea de forma automática y manual los pagos a comercios electrónicos.

Usos de la solución

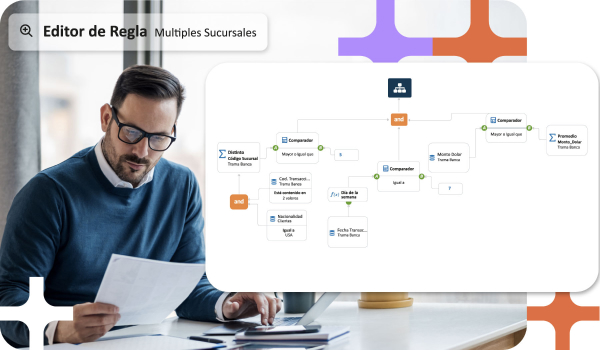

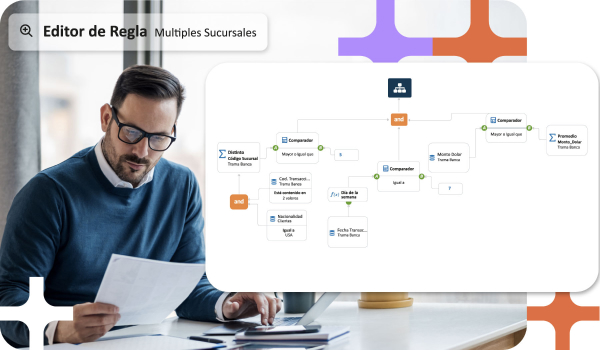

Modelos basados en reglas que se parametrizan mediante un editor gráfico e integran distintas fuentes, operadores estadísticas, funciones, listas, grupos de condiciones y fórmulas.

Evaluador de reglas inserto en el ambiente principal del sistema con análisis de impacto, eficiencia y falsos positivos.

Proyecta la actividad esperada de los comercios e identifica aquellos que presentan variaciones positivas o negativas en su facturación y en sus depósitos.

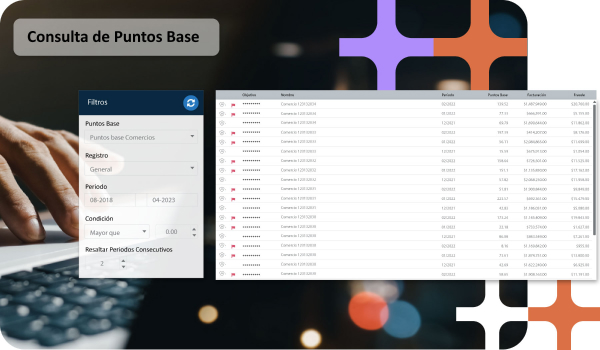

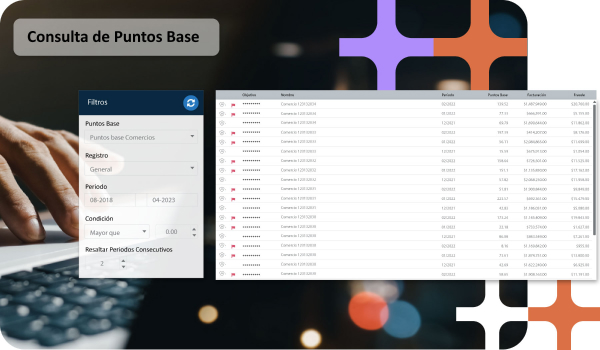

Identifica los puntos base de fraude de cada comercio y permite definir umbrales de alertamiento.

Genera bloqueos manuales o automáticos de los pagos a los comercios.

Modelos basados en reglas que se parametrizan mediante un editor gráfico e integran distintas fuentes, operadores estadísticas, funciones, listas, grupos de condiciones y fórmulas.

Evaluador de reglas inserto en el ambiente principal del sistema con análisis de impacto, eficiencia y falsos positivos.

Proyecta la actividad esperada de los comercios e identifica aquellos que presentan variaciones positivas o negativas en su facturación y en sus depósitos.

Identifica los puntos base de fraude de cada comercio y permite definir umbrales de alertamiento.

Genera bloqueos manuales o automáticos de los pagos a los comercios.

Descansa con toda tranquilidad

Confía en que detrás de tu organización, Sentinel vigila cada transacción

Beneficios

Hace que las transacciones de los tarjetahabientes sean más convenientes, confiables y seguras.

Permite implementar una estrategia de prevención de fraude por medio de un análisis desde múltiples perspectivas por distintos componentes tecnológicos.

Mejora la eficiencia y el rendimiento de su equipo de investigación, definiendo el flujo de trabajo y las acciones a tomar durante el análisis y revisión de una actividad inusual.

Ayuda a protegerse contra pérdidas provocadas por el incremento de fraudes confirmados.

Crea mejores prácticas y alertas de seguridad.

Potencia el negocio al incrementar los índices de aprobación y la disminución de contracargos.

Productos

Combate el crimen financiero de manera eficaz a través de sofisticadas herramientas.