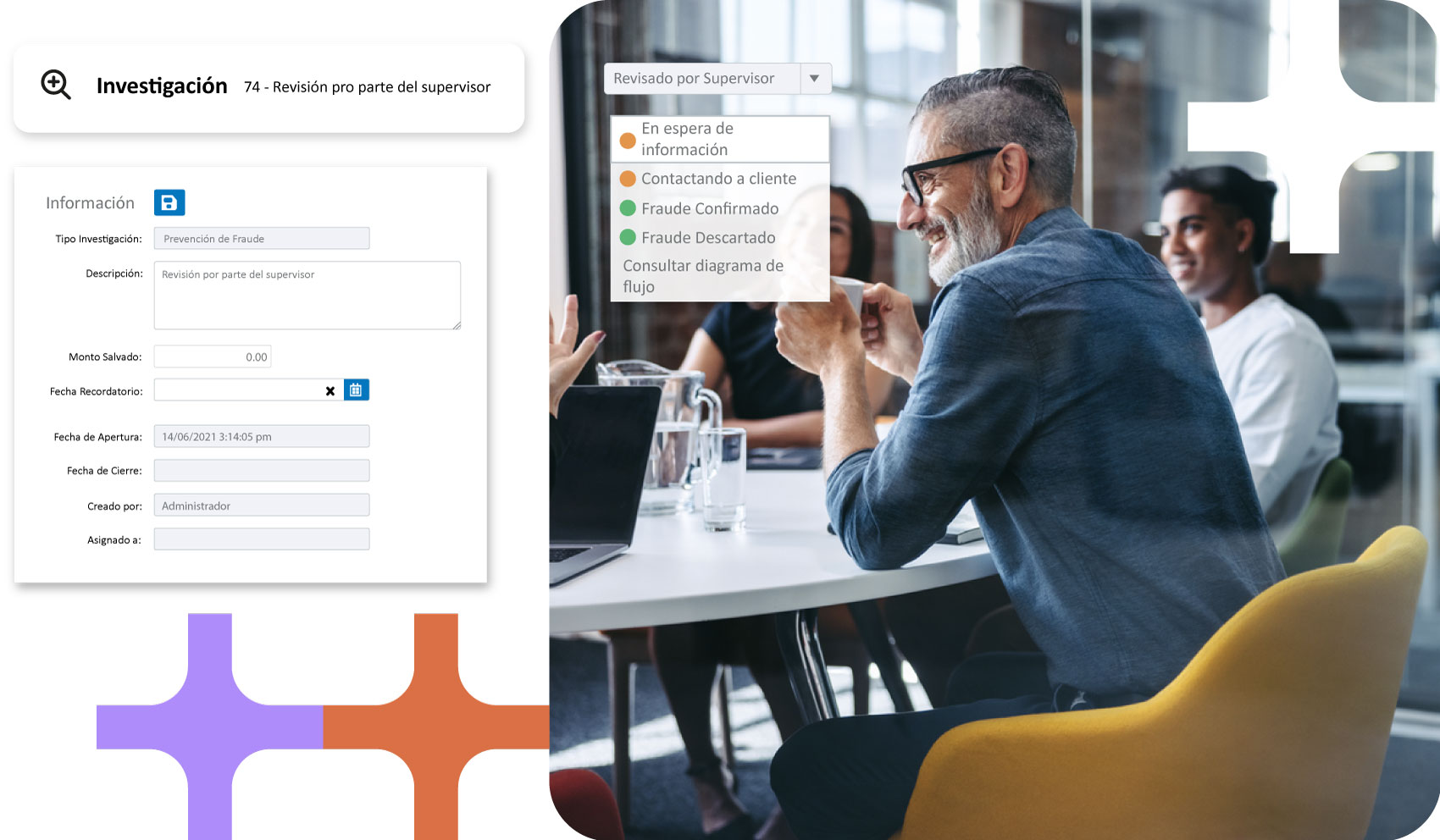

Sentinel Internal

Fraud

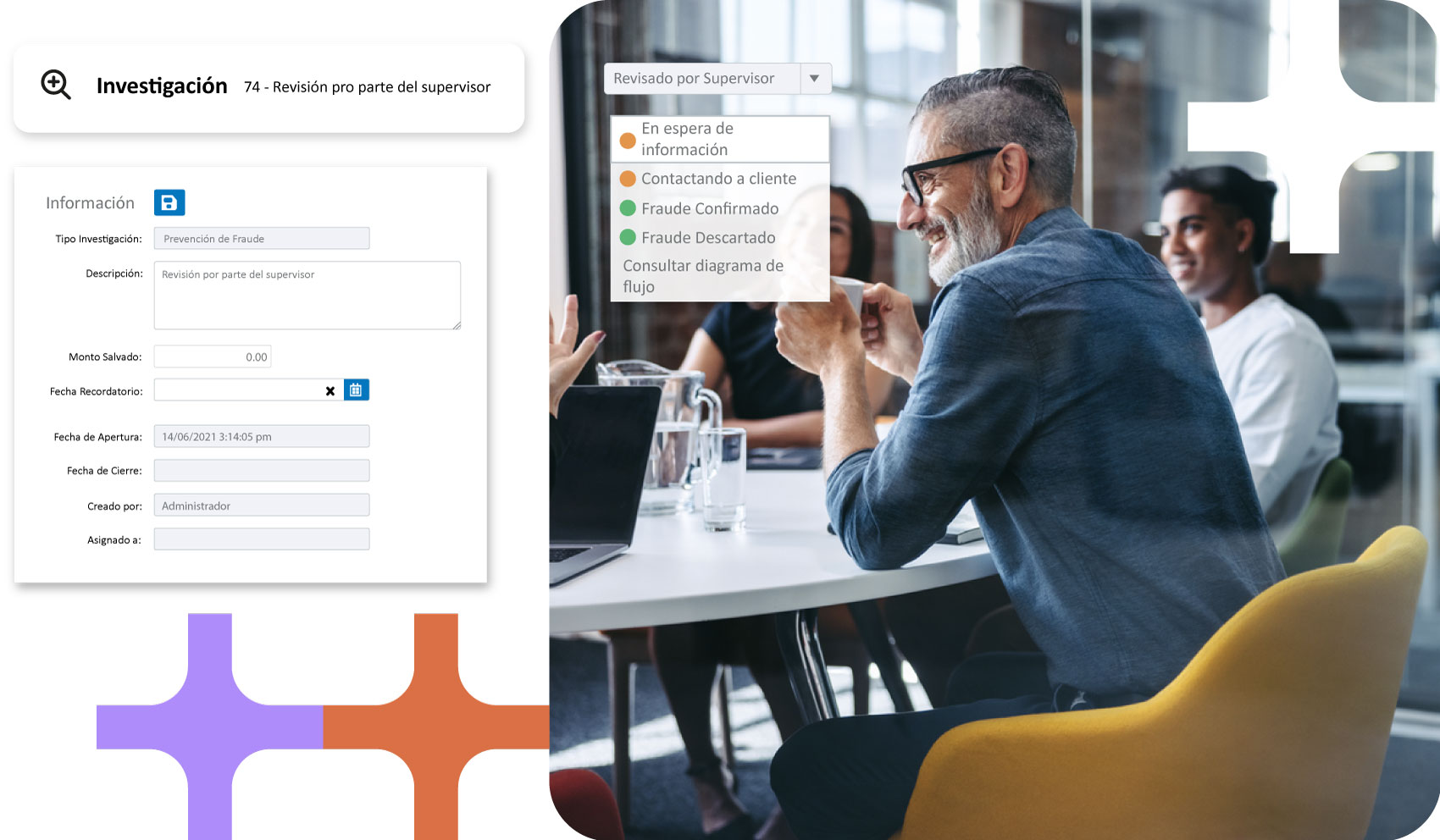

A service that includes different stages of risk analysis and internal fraud prevention, including multiple detection, investigation, reporting and dashboard technologies.

Characteristics

Losses due to internal fraud represent a major risk factor for the operation of financial institutions and have a very strong impact.

In addition, one of the main problems is the time required to detect fraud and therefore the effectiveness of the recovery.

Solution Uses

Risk profile of employees, based on multiple factors.

Historical behavior of the employee in corporate systems.

Early warnings of collaborators’ unusual behavior as part of internal management.

Integration with Human Resources systems and traceability analysis.

Tracking of customer accounts associated with the employee.

Risk profile of employees, based on multiple factors.

Historical behavior of the employee in corporate systems.

Early warnings of collaborators’ unusual behavior as part of internal management.

Integration with Human Resources systems and traceability analysis.

Tracking of customer accounts associated with the employee.

Rest easy

Trust that Sentinel keeps an eye on every transaction in your organization.

Benefits

Protects the company's assets against threats arising from within the company.

Reinforces the company's ethical values, monitoring employees’ internal behavior.

Ensures compliance with established internal policies.

Protects access to the company's physical security.

Protect the accounts of members.

Improves management and optimization of resources within the company

Helps disassociate from organized crime groups that threaten the company.

Products

Fight financial crime effectively with sophisticated tools.