AML/CFT

Cumple con los requerimientos regulatorios y gestiona de manera integral la prevención del lavado de dinero y financiamiento al terrorismo.

Características

Permite la validación del cliente contra listas restrictivas y su calificación de riesgo en el proceso de vinculación.

Cuenta con diferentes opciones de distribución de alertas, que incluyen enfoques centralizados o descentralizados.

Facilita la generación de reportes regulatorios.

Permite la construcción y parametrización de flujos de trabajo para la gestión de casos de investigación.

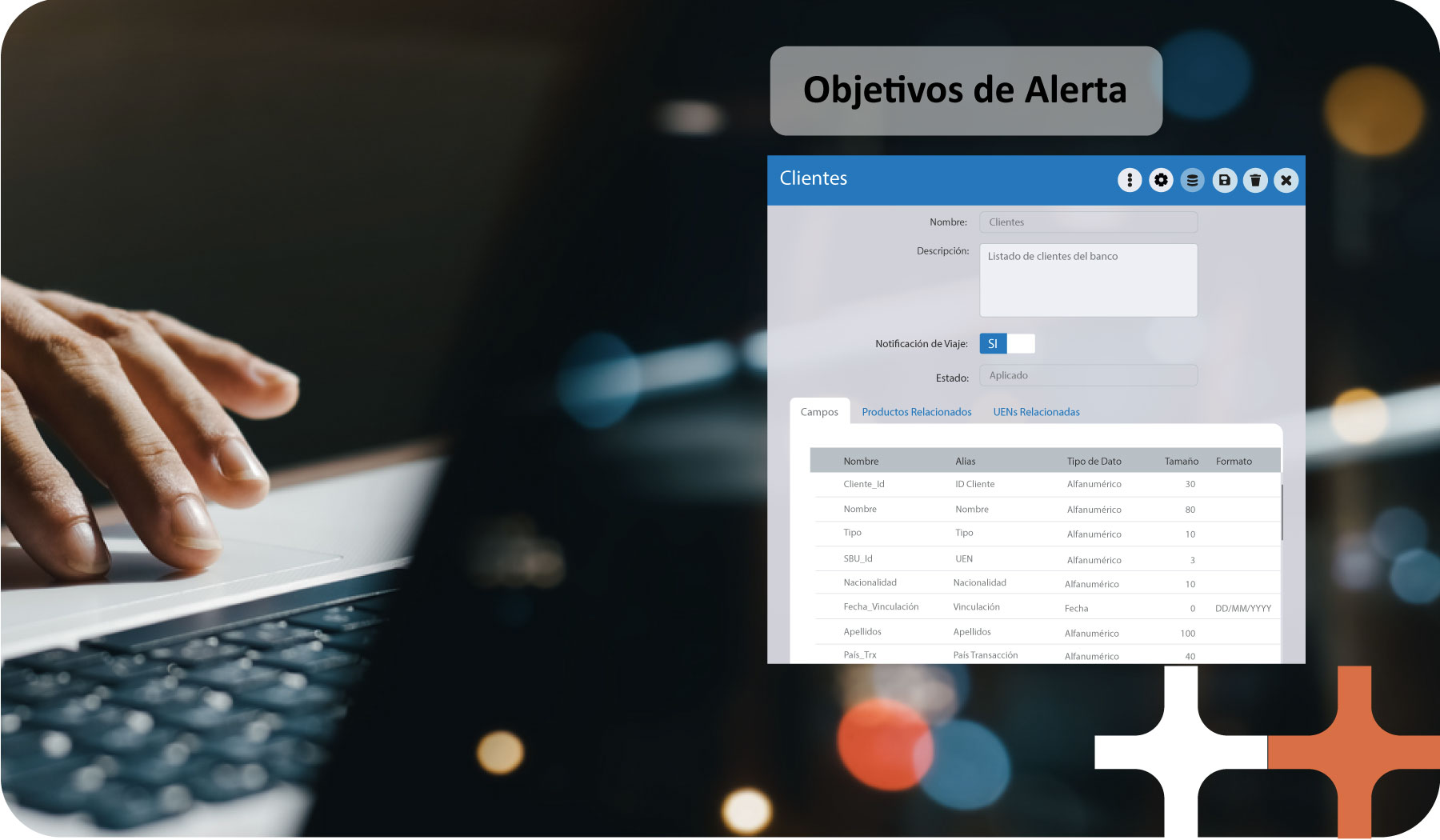

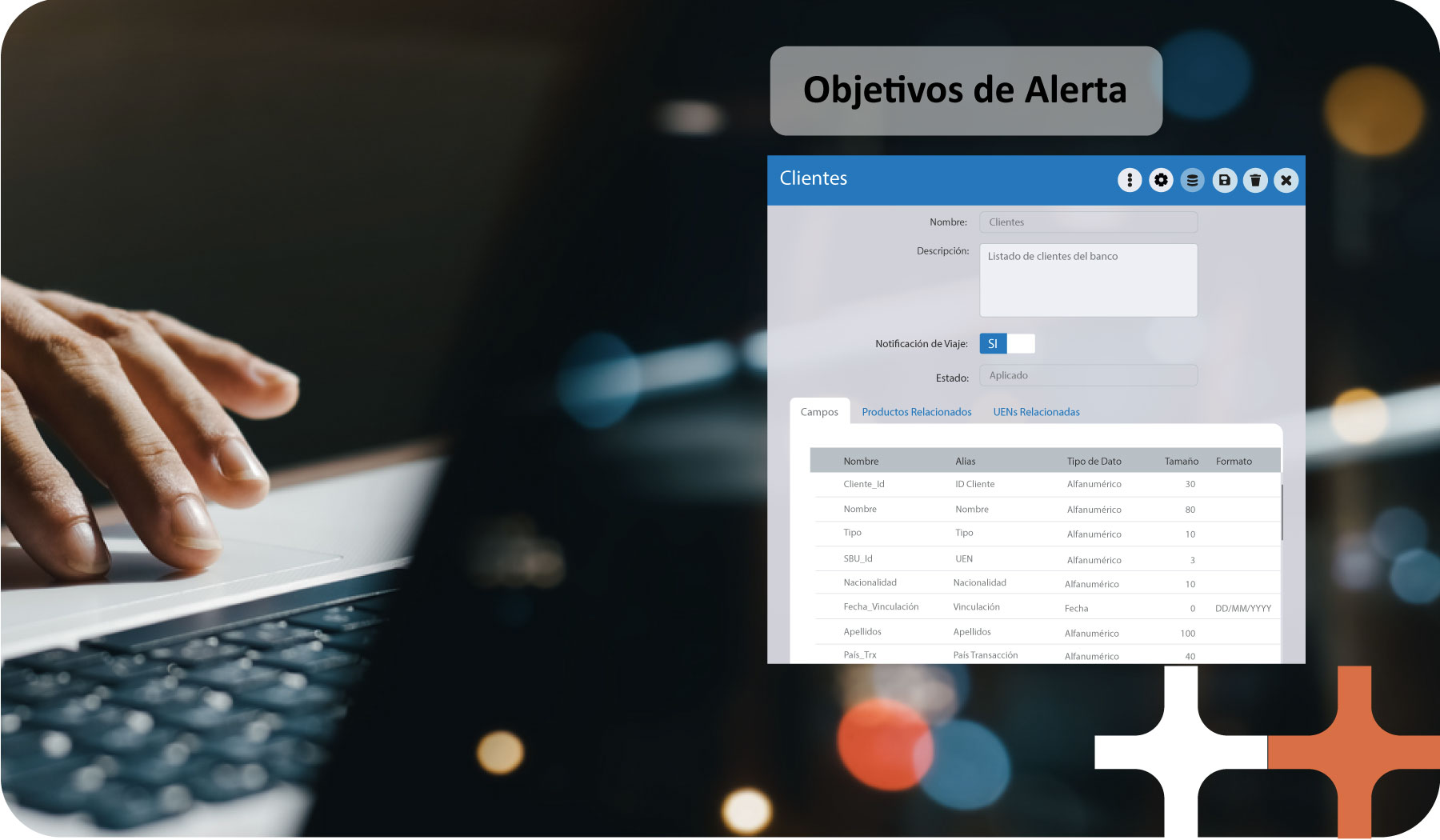

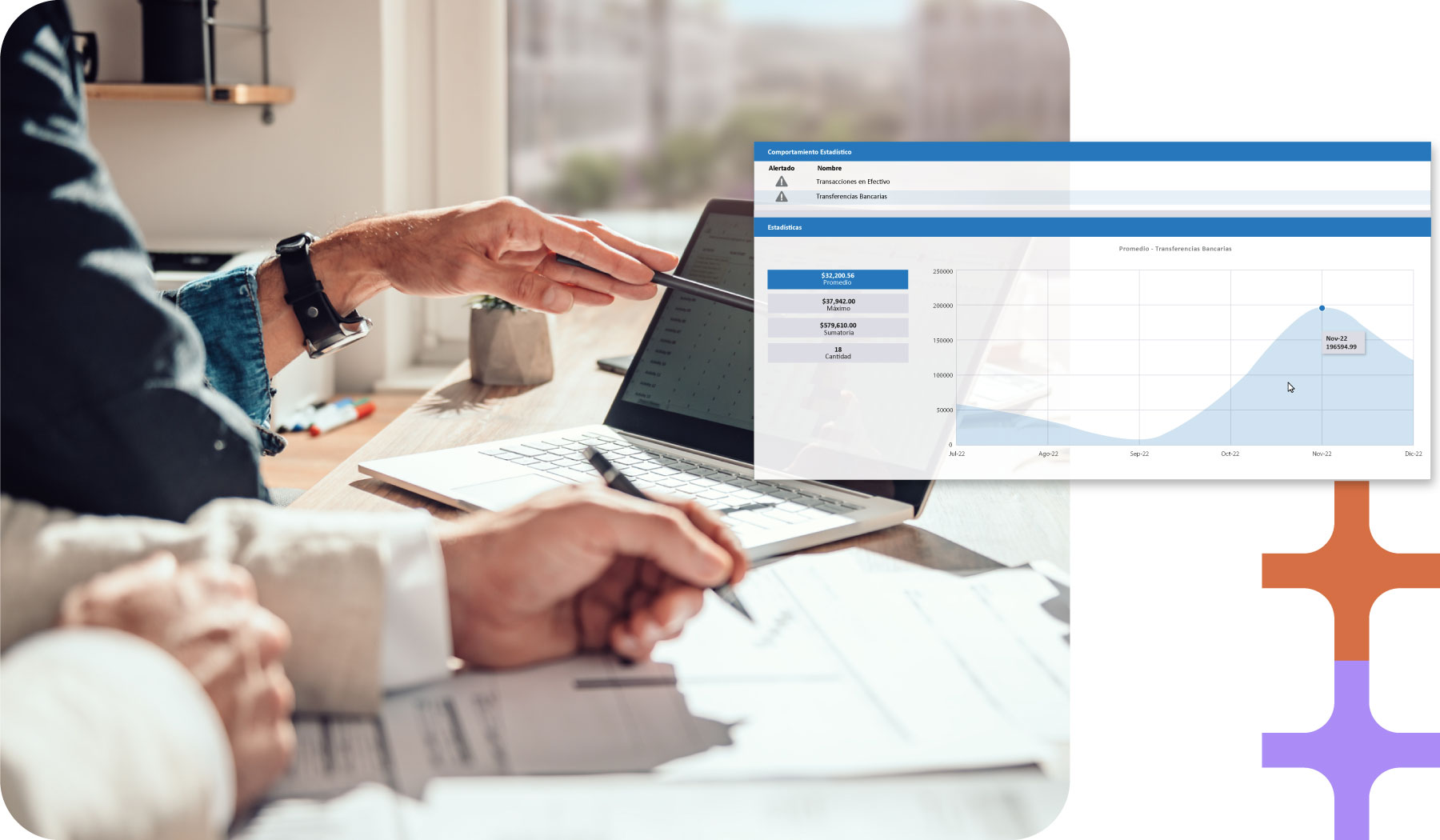

Ofrece la posibilidad de configurar modelos de alertamiento para identificar actividades sospechosas.

Automatiza la metodología de riesgos de la entidad.

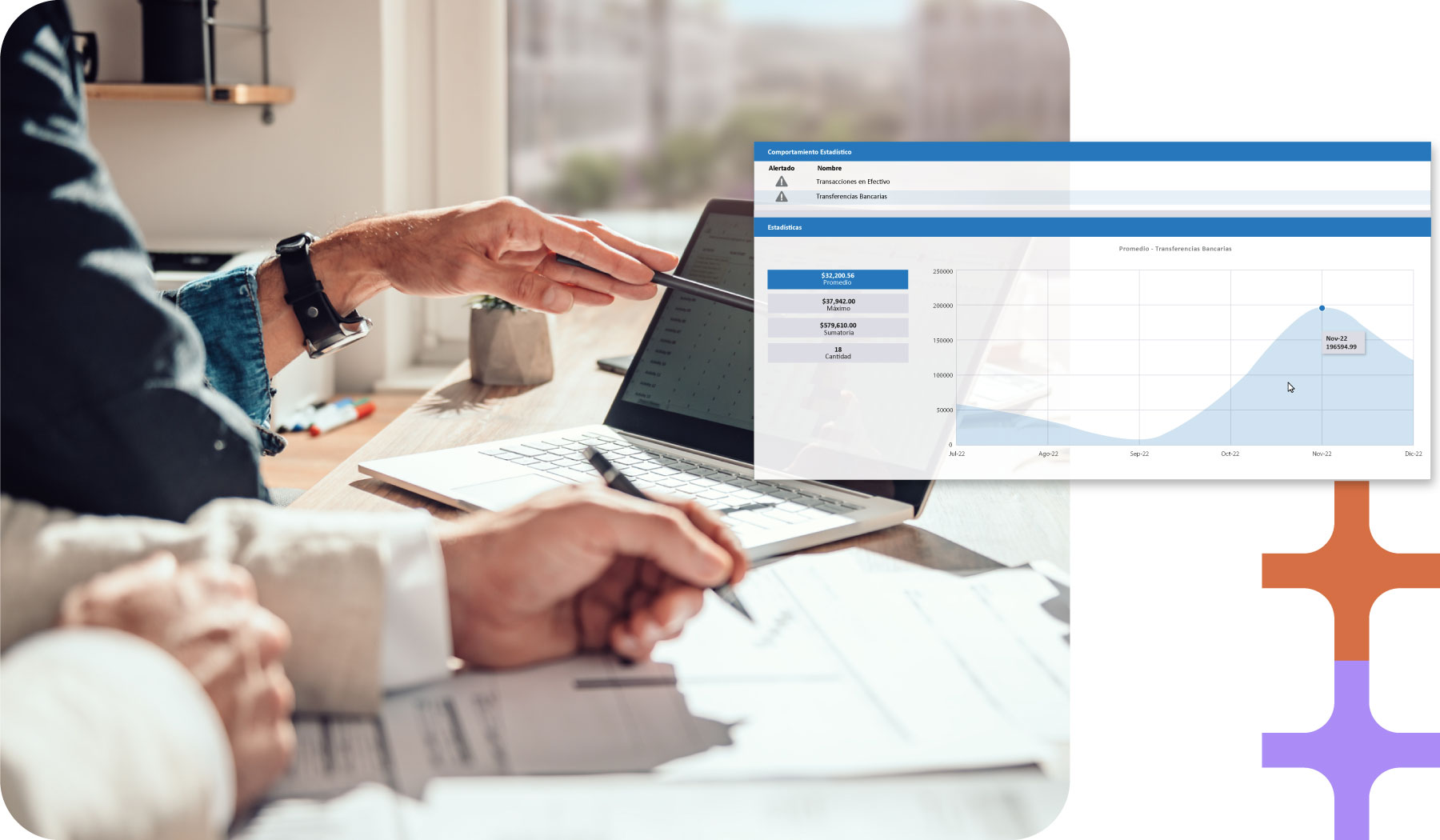

Muestra las desviaciones en el perfil declarado, según lo detallado en el KYC.

Usos de la solución

Sistema fácil de administrar, permitiéndole a un usuario la configuración del mismo sin mayor conocimiento técnico.

Poderosa funcionalidad de matriz de riesgo que considera factores cualitativos y cuantitativos.

Incluye funcionalidades para calificar el KYC, KYE y KY3 (proveedor).

Perfiles transaccionales del comportamiento a nivel de cliente.

Modelos basados en reglas que integran distintas fuentes, operadores, estadísticas y fórmulas.

Evaluador de reglas inserto en el ambiente principal del sistema, con análisis de impacto, eficiencia y falsos positivos de las reglas.

Distribución de alertas e investigaciones a los analistas.

Inclusión de procesos que permiten automatizar la debida diligencia de la institución.

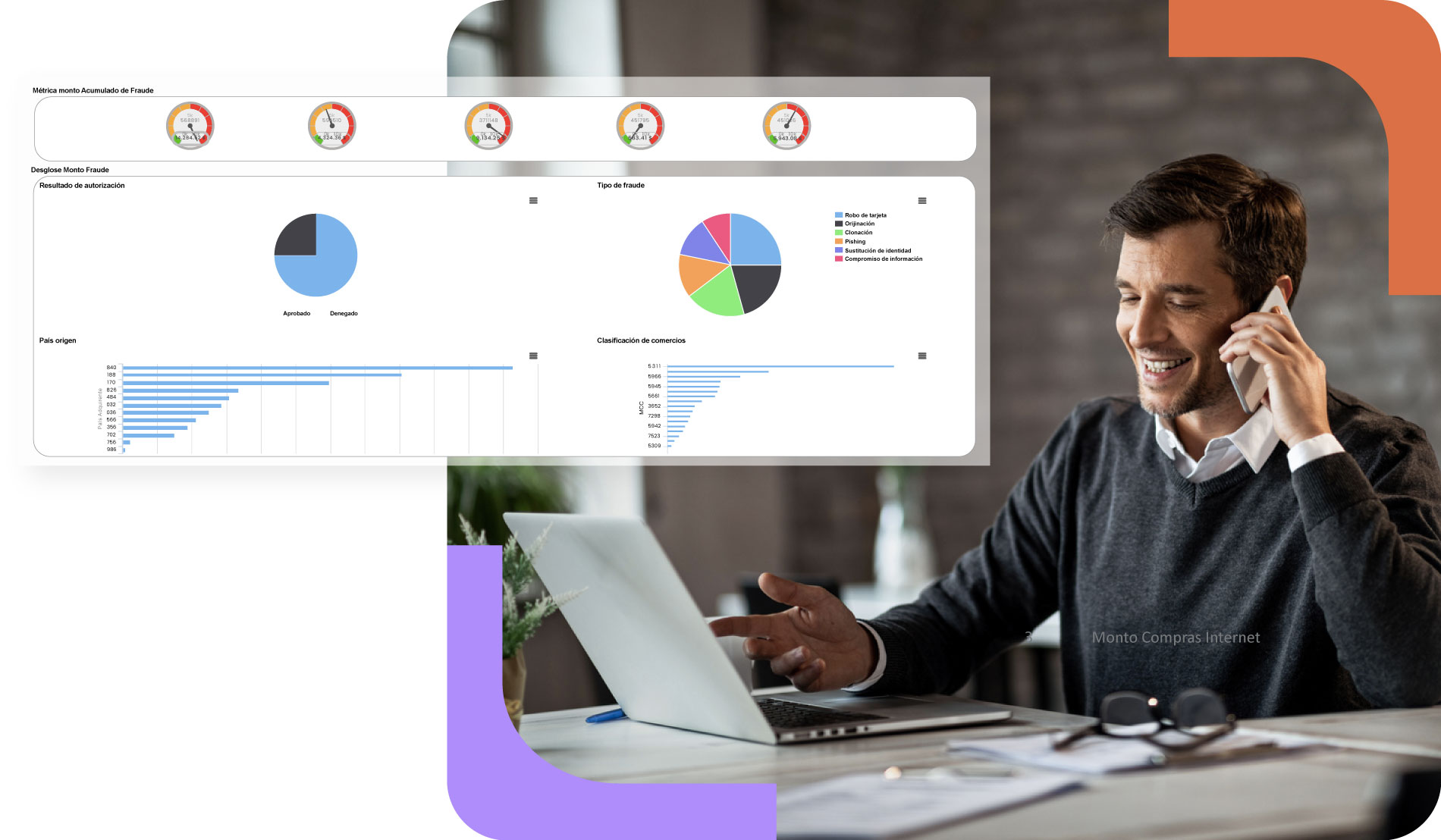

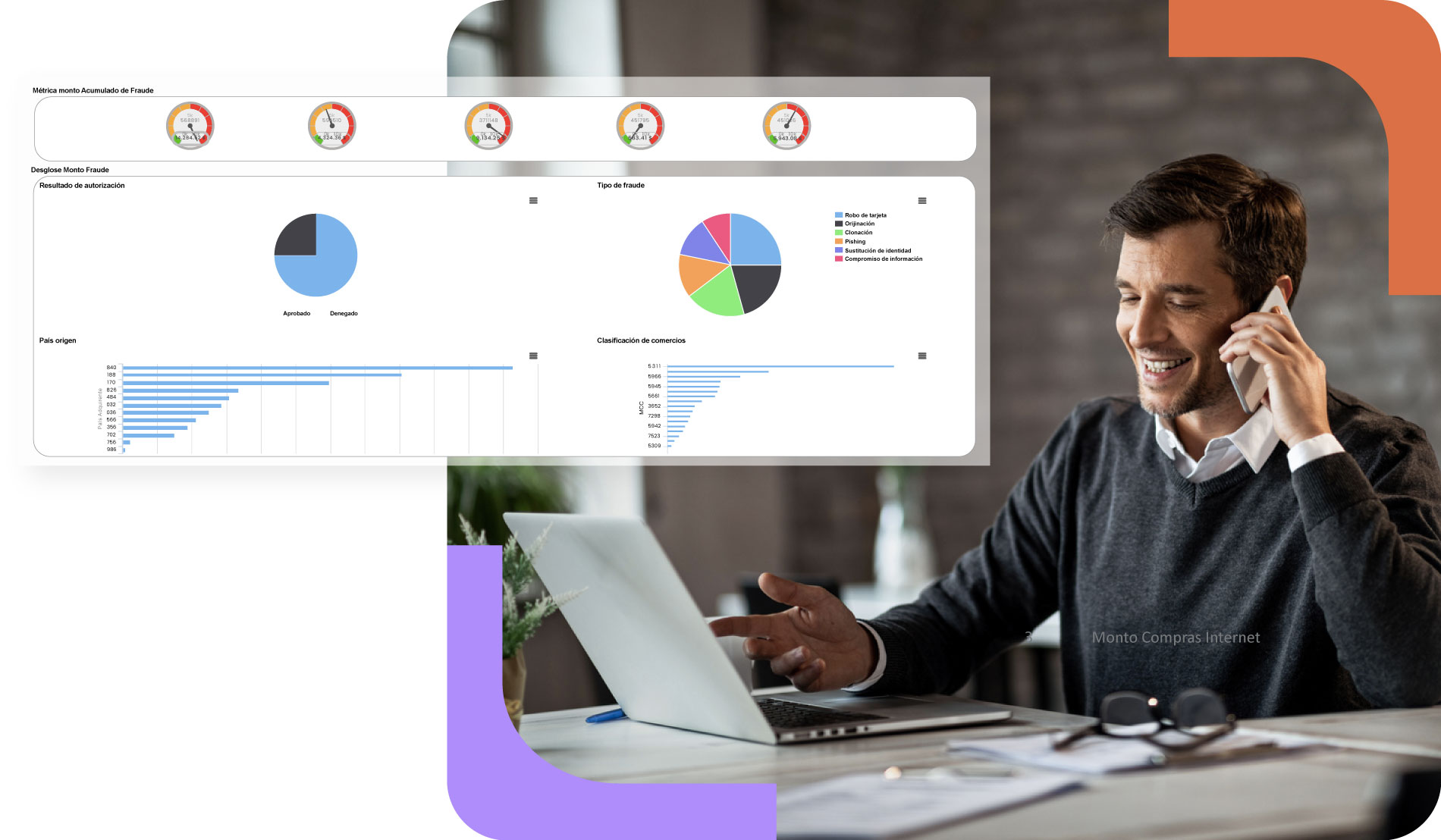

Generación de reportes y tableros especializados.

Sistema fácil de administrar, permitiéndole a un usuario la configuración del mismo sin mayor conocimiento técnico.

Poderosa funcionalidad de matriz de riesgo que considera factores cualitativos y cuantitativos.

Incluye funcionalidades para calificar el riesgo de clientes, proveedores y colaboradores.

Perfiles transaccionales del comportamiento a nivel de cliente.

Modelos basados en reglas que integran distintas fuentes, operadores, estadísticas y fórmulas.

Evaluador de reglas inserto en el ambiente principal del sistema, con análisis de impacto, eficiencia y falsos positivos de las reglas.

Distribución de alertas e investigaciones a los analistas.

Inclusión de procesos que permiten automatizar la debida diligencia de la institución.

Generación de reportes y tableros especializados.

Descansa con toda tranquilidad

Confía en que detrás de tu organización, Sentinel vigila cada transacción

Beneficios

Concordancia con las mejores prácticas y normativas nacionales e internacionales.

Permite implementar una estrategia de prevención de fraude por medio de un análisis desde múltiples perspectivas por distintos componentes tecnológicos.

Ayuda a protegerse contra la afectación que pueda resultar por daños reputacionales o de imagen.

Crea mejores prácticas y alertas de seguridad.

Mejora la eficiencia y el rendimiento de su equipo de investigación, definiendo el flujo de trabajo y las acciones a tomar durante el análisis y revisión de una actividad sospechosa.

Productos

Combate el crimen financiero de manera eficaz a través de sofisticadas herramientas.