Sentinel Digital Channels Fraud

Prevent, detect, and eradicate fraud in real-time within your associates’ transactions.

Características

Allows you to decline or approve transactions in real time.

Notifies the customer of potential fraud via SMS or email.

Creates transactional behavior profiles.

Identifies risky connections based on a customer's geographic location.

Rates transaction risk.

Automatically implements a block in case of failed login attempts by a user.

Automatically and manually blocks risky transactions.

Solution Uses

Rule-based models set up using a graphical editor and integrating different sources, statistical operators, functions, lists, condition groups, and formulas.

Transactional profiles of customer behavior.

Rule evaluator inserted in the main system environment with impact, efficiency and false positive analysis.

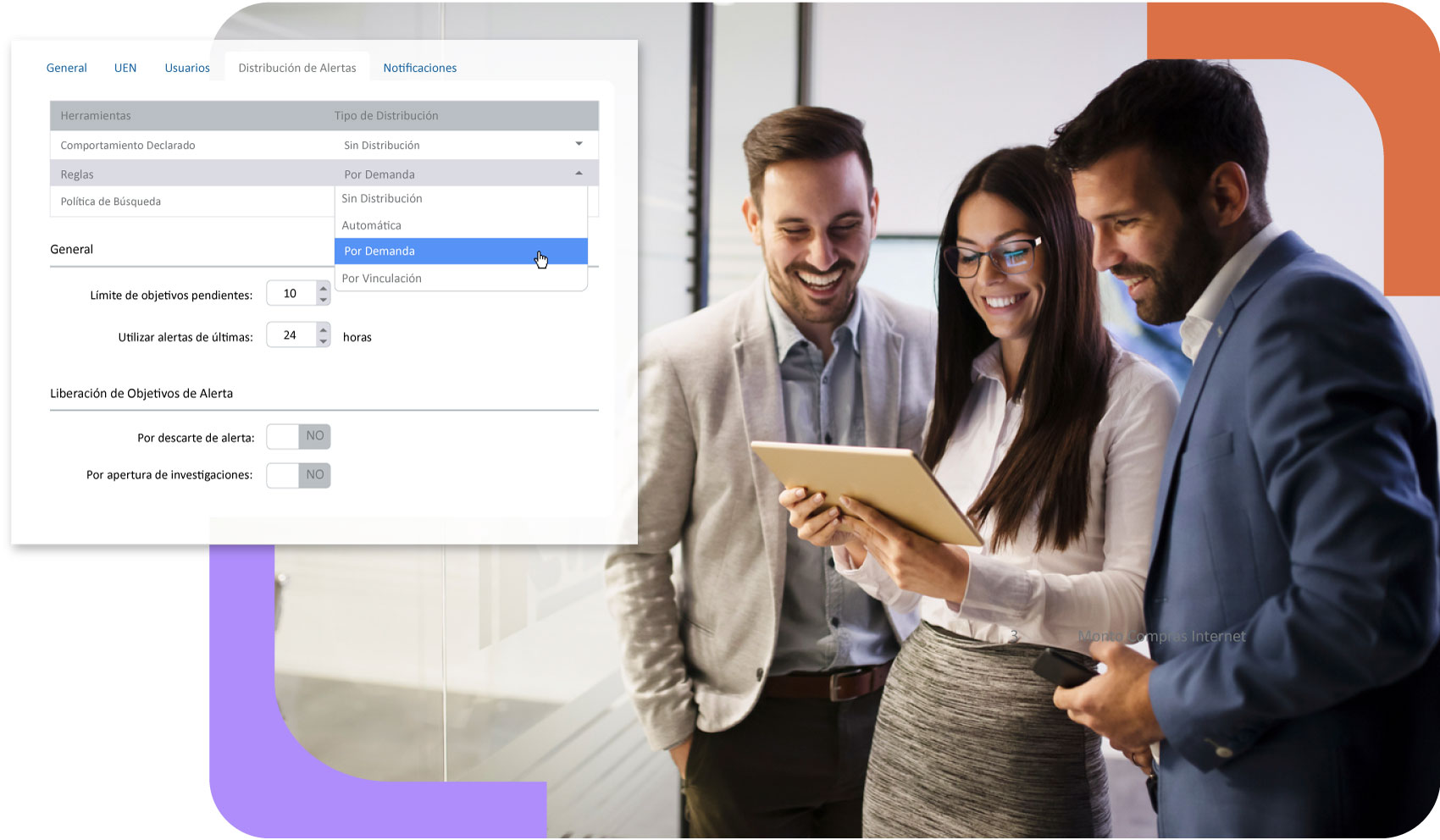

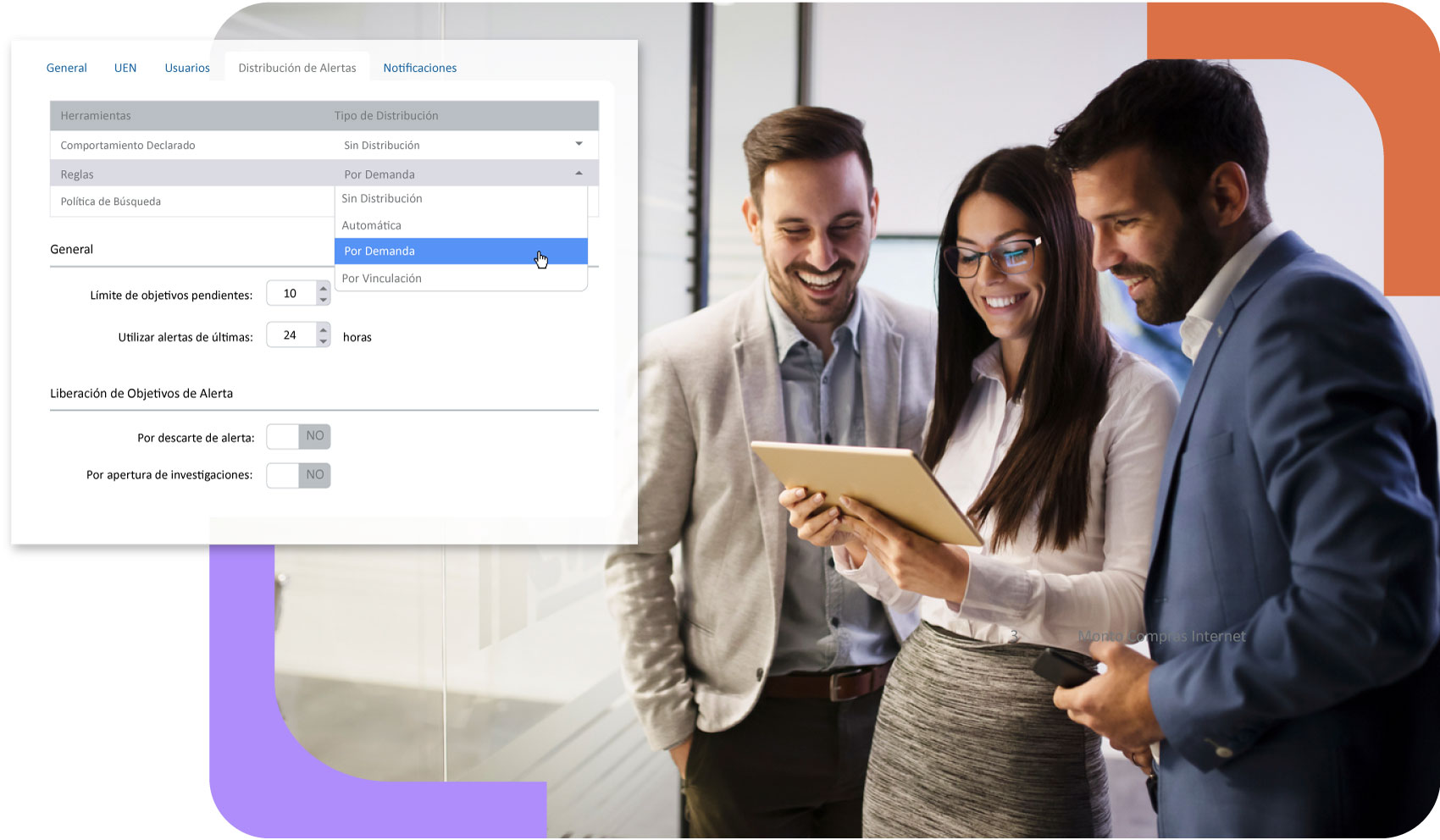

Distribution of alerts and investigations according to different criteria defined by the user.

Rule-based models set up using a graphical editor and integrating different sources, statistical operators, functions, lists, condition groups, and formulas.

Transactional profiles of customer behavior.

Rule evaluator inserted in the main system environment with impact, efficiency and false positive analysis.

Distribution of alerts and investigations according to different criteria defined by the user.

Rest easy

Trust that Sentinel keeps an eye on every transaction in your organization

Benefits

Allows defining the georeferential behavior of the associate.

Implements a fraud prevention strategy through the analysis of different technological components from multiple perspectives.

Makes customer transactions more convenient, reliable and secure.

Creates best practices and security alerts.

Improves efficiency and performance of your research team by defining workflow and actions to be taken during the analysis and review of any unusual activity.

Helps protect against losses caused by an increase in confirmed fraud.

Products

Fight financial crime effectively with sophisticated tools.